The rumors about Salesforce acquiring Informatica induced both a chuckle and a head shake. This isn’t a critique of either company. Both are leaders in their fields, but I wanted to share some observations about past acquisitions of this nature. Before I dive into that, I don’t want to presume that EVERYBODY reading this knows exactly what Informatica does. I’m going to spend 1 paragraph on it and Salesforce. I’ll title them so you can skip them if you already know.

Informatica

Informatica’s founding came from the Extract, Transform, and Load (ETL) space. Their tooling allowed developers to set up scheduled frameworks to extract data from databases, transform that data, and then load that data into a target database of choice. All of this came in a nice user interface which had a widget for each step connected with lines, so the flow was somewhat self-documenting. That is their genesis, from there they acquired and innovated into many other data-oriented disciplines which made them a consistent catch-all data manipulation tool that corporations could leverage.

Salesforce

Salesforce’s founding was in the Customer Relationship Management (CRM) space. Their tooling allowed sales reps to manage the process of maintaining their customer relationship. They were the first to adopt a cloud-centered CRM which made them an easy-to-start incumbent against slow and hard-to-configure on-premise systems. They had a meteoric rise, acquiring and building their own application processes they could fit into their platform. This effectively turned Salesforce into a platform that dominates a series of processes within organizations, stopping short of full-on ERP functionality.

The Value of Data-to-Information Tools

I would fit ETL in the Data-to-Information category. What is that? Well, imagine you purchase a smartphone. That information about your purchase gets rolled up to financial projections, regional sales forecasts, upsale analytics, etc. The tooling that graduates those raw events in data, to strategic information assets, is what I would deem as Data-to-Information tools.

Informatica plays a pivotal role for organizations in making the logic for those events easier to set up in a self-documenting workflow interface. Other tools in the Data-to-Information value chain exist like Tableau (another Salesforce acquisition) which visually displays the information in appealing dashboards.

Within this value chain, Informatica has many backend capabilities that provide readily available tools for improving the Data-to-Information process. But there’s one thing that has kept Informatica in a league of its own… Loose Coupling.

Loose Coupling: The Foundation of Data-to-Information Value

Loose coupling is precisely as it implies: independent systems interacting through defined interfaces to accomplish tasks without negatively impacting each other. The independence of systems allows for systems to be upgraded without breaking other systems. This independence also ensures that they must be open and ready for whatever comes their way.

When it comes to data there is no shortage of variety, and use cases. There isn’t 1 source of data in a corporation’s Data-to-Information chain, and there isn’t 1 target of information in that chain either. So the value of a tool like Informatica is in its loose coupling to broadly address the cacophony of source systems it needs to integrate. Their ability to approach an SAP use case, a Salesforce use case, an Oracle use case, a SQL Server use case, and a fill-in-the-blank use case is what makes them important to their customers. The more the balance is tipped to a single use case, the less useful it becomes to the market. And this happens despite the marketing and internal mite to the contrary. Hyperfocusing on a single use case does by definition tip the balance… and we’ve seen this before.

SAP's Acquisition of BusinessObjects

In 2007 SAP, a company that specializes in Enterprise Resource Planning (ERP) acquired Business Objects. Business Objects was a darling of the Data-to-Information industry. They offered a full stack of tools all the way to the analytics layer. They weren’t quite as independent as Informatica was, as they serviced both the back end and the front end value chain, but their backend tool called Data Integrator supported a very wide range of source systems like Informatica. This was at the time a direct competitor to Informatica’s PowerCenter. Both tools could be deployed in a loosely coupled form, allowing data to be Extracted and Loaded to independent databases while Transforming it. SAP reassured the world that Business Objects wasn’t going anywhere and that it would remain the independent leader in the Data-to-Information chain.

The chatter between Informatica sales reps and existing Business Objects Data Integrator customers was that Business Objects would lose their independence. This could have been waved off as FUD, but the inevitable tipping of the balance happened over time. Today it is truly rare to see a non-SAP ERP customer buying SAP BusinessObjects Data Services (the current name for their integration tooling) to do their data integration work.

Post-acquisition, the SAP reps were given a golden goose to sell to their customers. In typical SAP fashion, customers were given an offer they couldn’t refuse, and they found themselves with a data integration and BI tool. The force of revenue was so enormous that the Business Objects Product Managers couldn’t help but lean into SAP's edge cases.

In the end, the Informatica sales reps were right. Informatica experienced an enormous amount of growth from 2010-2015, taking advantage of their independent posturing with non-SAP customers. What might come as a surprise is that Informatica succeeded even with SAP customers. The issue at hand was that data never comes from just 1 source. So while SAP BusinessObjects was heads down filling in the edge cases for SAP, they were too distracted to see all the other important data sources that were becoming critical to their customers, chalking up wins for Informatica.

Chalk and Cheese

ERP and CRM are packaged process offerings. They operate people and machines by giving them data entry points along the path of a process. The data is simply an appendage of that process. What increases the value of a process offering is greater step efficiency and higher happy-path throughput.

Data-to-information tooling is a completely different animal. Their value is derived from treating data (that often comes from CRM and ERP tools but rarely is exclusive to them) as a malleable asset and making that asset scalable to the enterprise.

If the CRM vendor gets their way, they’ll push the Data-to-Information vendor to “solve for our CRM”, rather than solve for all data. You won’t see that in the marketing of course.

The Narrow Case

The narrow case where acquiring a Data-to-Information tooling company can make sense is within the lanes of Data-to-Information. For example, Business Objects did remarkably well acquiring Acta Technology which became their Data Integration tooling. This appeared to create issues with the rest of the BI and ETL vendors, but because ultimately their competitors were producing roughly the same output at the end of the ETL process it really didn’t make that big of a difference. Where it became useful was in tracking the lineage of reports down the source tables. This mostly made for cool demos, but it worked, customers were flocking to the combination of Business Objects for Analytics and Data Integrator for integration.

Something to Understand About Data Pipelines

There used to be a pretty hilarious trend amongst ETL vendors. They would use their customer retention numbers to indicate customer satisfaction. The truth is a company would have to be driven to madness to rip and replace these automated systems. The effort was so difficult to do that it simply wasn’t worth it. So on that backdrop, from a customer perspective: The narrow cases where it makes sense to acquire Data-to-Information tooling companies are where customers don’t feel their pipelines are at risk from the acquisition. Where it strengthens or at least stays neutral, this is usually a positive for customers. However, when it weakens their seemingly bulletproof backends, customers start looking for the exits.

Sensitive Timing

The marriage of a CRM and an ETL tool is coming at a sensitive time. The advent of all these cloud data platforms has upended all the connections these Data Integration frameworks have presumed would always be there. So whether the corporation liked it or not, the ETL frameworks had to be messed with. Informatica has done a good job of shoring up many of their customers to move to their cloud platform, but inevitably there are exits as well.

The effort to move off these systems is not a casual event, even for those staying in the Informatica ecosystem. There is automation to help, but still, these are real projects with big teams getting it done. Rocking the boat with an acquisition is coming at a sensitive time.

Who Would Win

One thing that was pretty hard to ignore was the massive uptick in Business Objects sales when SAP acquired them. The real winners there were the sales reps. I would suspect the same would be the case for Salesforce Reps. That initial glut smoothed out as the lines between BusinessObjects and SAP vanished.

Customers who are all-in on both platforms will surely be well-serviced with better support for data management edge cases related to Salesforce. While this might come at the expense of stronger support for other systems, the low-hanging fruit will prove too tempting.

PySpark and SQL may be the real winners, as large organizations seem to be tempted to adopt these languages as replacements for visual data workflows. The reluctance to touch the back-end code, is driving interest in ironclad ways of never having to touch it again. With all the cloud vendors supporting these standards, the temptation to move to such is very real.

The case for acquiring a Data-to-Information platform is very narrow. If Salesforce moves forward with the acquisition, at the very least this whitepaper can serve as an awareness of the forces that will be tugging post-acquisition.

Who is Intricity?

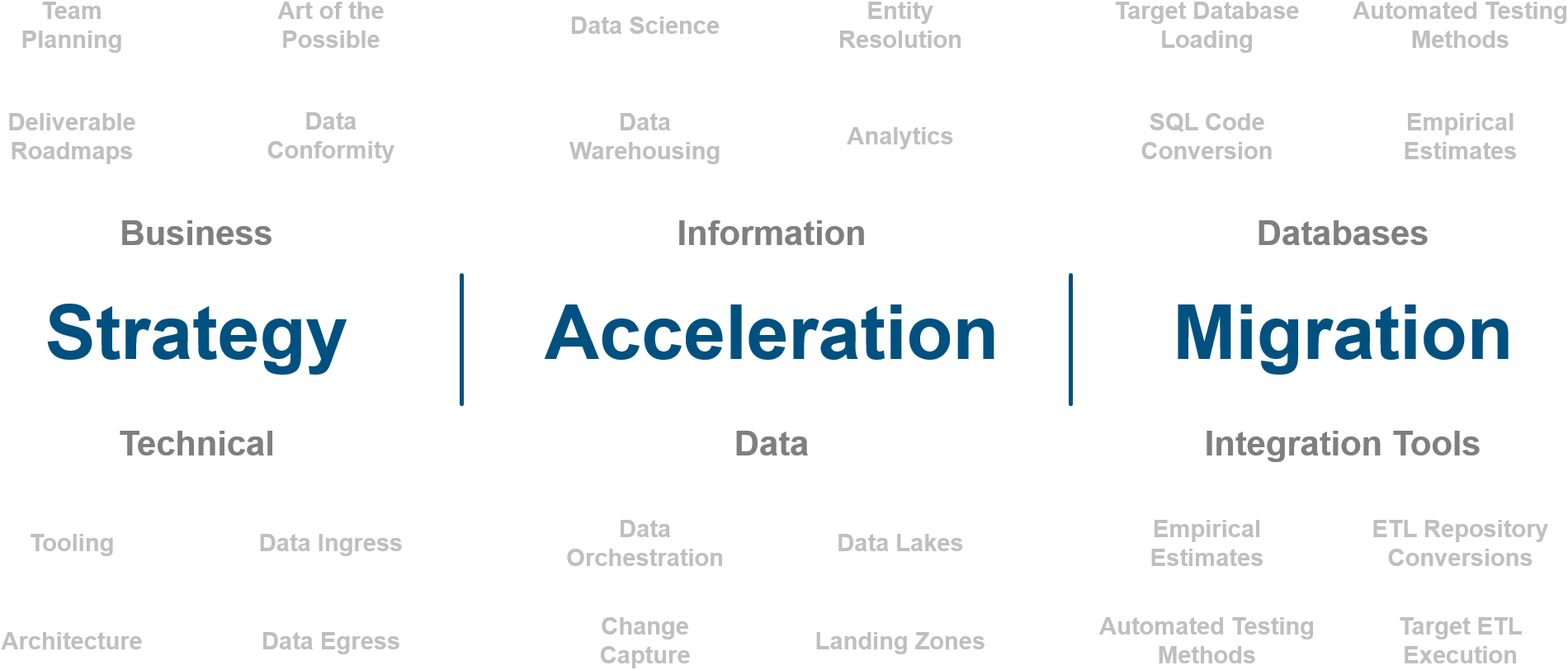

Intricity is a specialized selection of over 100 Data Management Professionals, with offices located across the USA and Headquarters in New York City. Our team of experts has implemented in a variety of Industries including, Healthcare, Insurance, Manufacturing, Financial Services, Media, Pharmaceutical, Retail, and others. Intricity is uniquely positioned as a partner to the business that deeply understands what makes the data tick. This joint knowledge and acumen has positioned Intricity to beat out its Big 4 competitors time and time again. Intricity’s area of expertise spans the entirety of the information lifecycle. This means when you’re problem involves data; Intricity will be a trusted partner. Intricity's services cover a broad range of data-to-information engineering needs:

What Makes Intricity Different?

While Intricity conducts highly intricate and complex data management projects, Intricity is first a foremost a Business User Centric consulting company. Our internal slogan is to Simplify Complexity. This means that we take complex data management challenges and not only make them understandable to the business but also make them easier to operate. Intricity does this through using tools and techniques that are familiar to business people but adapted for IT content.

Thought Leadership

Intricity authors a highly sought after Data Management Video Series targeted towards Business Stakeholders at https://www.intricity.com/videos. These videos are used in universities across the world. Here is a small set of universities leveraging Intricity’s videos as a teaching tool:

Talk With a Specialist

If you would like to talk with an Intricity Specialist about your particular scenario, don’t hesitate to reach out to us. You can write us an email: specialist@intricity.com

(C) 2023 by Intricity, LLC

This content is the sole property of Intricity LLC. No reproduction can be made without Intricity's explicit consent.

Intricity, LLC. 244 Fifth Avenue Suite 2026 New York, NY 10001

Phone: 212.461.1100 • Fax: 212.461.1110 • Website: www.intricity.com

Sample@gmail.com appears invalid. We can send you a quick validation email to confirm it's yours